About These Guidelines

There are hundreds of trained end-of-life doulas (EOLDs) in the U.S. marketplace and abroad, some of whom are choosing to organize working groups for mutual support, commerce/business development, and/or for broadening their service offerings.

The National End-of-Life Doula Alliance (NEDA) has developed this set of suggested guidelines as a roadmap to assist and support EOLDs with structuring their own emerging groups. These guidelines are intended as a resource to help create and build professional end-of-life doula groups.

As a networking and information hub, NEDA is positioned to bring together EOLDs in a way that enhances their individual and collective knowledge as well as their business opportunities.

Further, NEDA and its partners are able to lend support and credibility to groups of EOL practitioners as they forge their presence in their respective communities. In keeping with its vision, NEDA wishes to help achieve status for EOLDs as qualified practitioners who provide appropriate integrative and ethical care for all people at end of life.

NEDA maintains that there is great value in forming groups, and has identified the following benefits associated with being involved in a group:

These guidelines are intended as a launching point, and we wish you and your group the best in success as you design your unique end-of-life doula business practice.

Definitions

Agency

A for-profit business that provides services that connect practitioners and clients. AKA Referral or Staffing agency.

Affinity Group

A group formed around a shared interest or concern, common ideology or goals.

Alliance

An entity that combines the resources of two or more groups or individuals to achieve strategic goals, leverage resources, and increase success potential while reducing risks.

Collaborative

A working group consisting of two or more people or organizations formed for a particular purpose that serves the common good.

Collective/Cooperative

A group of individuals who join together to achieve common objectives for the mutual benefit of its members.

Community of Practice Group

People who share information and experiences within the group to provide opportunities for personal and professional development.

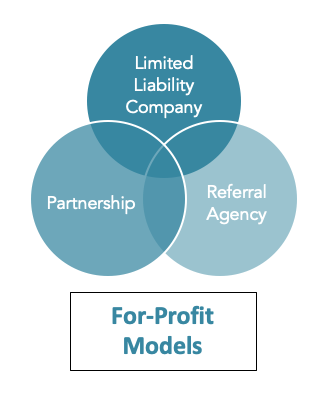

Limited Liability Company

A limited liability company (LLC) is a business in which the owner or owner/member(s) are not personally liable for their company's debts or liabilities.

Network

A group or a system of interconnected people or things.

Not-For-Profit Organization

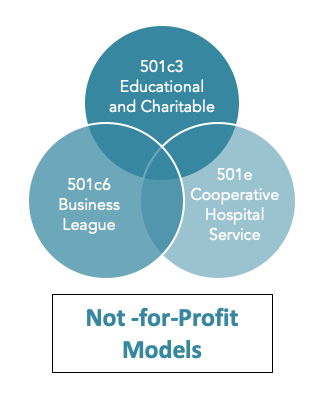

A tax-exempt, incorporated organization in which neither shareholders nor trustees benefit financially and that serves some public purpose or social cause. 501c3 nonprofits focus on educational and charitable causes, while 501c6 nonprofits are classified primarily as business leagues.

Partnership

A legal entity comprised of two or more partners who share profits & losses.

For-Profit Business

Any business that seeks to generate income for their owners and employees by providing goods and/or services for a fee.

Professional Common Interest Group

A professional association that advocates for the economic and professional development of their members and constituents, such as trade unions and associations. The group may provide certification, professional conduct guidelines, codes of ethics, and shared personal and professional insurance coverage.

Professional Interest Support Group

An organized group of skilled workers who share resources, expertise, and concerns regarding their profession for the purpose of mutual aid and shared problem-solving to reduce solation and increase support between professional peers.

Sole Proprietorship

When two or more people engage in business practices for the purpose of making money with an agreement on division of labor, including business decisions, administrative tasks, liability, and income. If you are earning self-employed income and you have not incorporated, you are a sole proprietor.

Working Group

Any group of individuals with relevant knowledge and skills in specific areas who collectively undertake assigned tasks and activities in order to achieve specified goals and/or a stated objective.

How to Start a Regional Group

All groups hope to promote their mission and services, build a community presence, and sustain their operations. Initiating the setup of any entity begins with the purpose that brings together a community of like-minded individuals who share a purpose and vision. The order of the actions a group takes depends on what works best for the members, taking into consideration the operating and partnership agreements.

Forming a group—the startup process:

Some structural elements for consideration:

Set-up costs:

Depending on the individual skill sets member volunteers bring to the group, you may be able to defray startup costs significantly. Expect that there may be additional fees and professional services that must be outsourced. Keep in mind that partnerships with a college business class, friendly web developer you know, community leaders who support EOLD work, and other contacts may contribute pro bono to help lower costs in the startup phase.

Fees will vary for many reasons, and depending on where the group is located, whether urban, suburban, or rural. See www.incfile.com/state-filing-fees/ for a chart of fees by state for LLC, nonprofits, and corporations. Here is a range of anticipated startup costs (accessed 2020):

Professional services:

Along with legal, accounting, and marketing services, the group will want to take stock of their specialty areas and decide if and how they’d like to expand their group offerings. Some EOLD groups contract with, or at least have access to, the following:

The timeline:

The group’s expectations will affect how long it takes the association to grow. A realistic inventory of personal time commitments, frequency of meetings, how dedicated the group is, and the anticipated pace of group development should be evaluated; all these factors and more will influence how long each step and the overall process will take. An ambitious startup can happen within a year. An organic approach to the process does not emphasize time goals, so members should allow for plenty of time for the group to establish.

Governance Models to Consider

Community of Practice Groups

A Community of Practice Group, also known by these interchangeable terms, may also operate as a:

Some characteristics of a Community of Practice Group include:

Elements of a Community of Practice group include:

Tips for forming a Community of Practice Group:

Setting up a Community of Practice Group:

Professional Advantages of a Community of Practice Group may include:

Possible business advantages of a Community of Practice Group:

Limitations of Community of Practice Groups may include:

The National End-of-Life Doula Alliance (NEDA) has developed this set of suggested guidelines as a roadmap to assist and support EOLDs with structuring their own emerging groups. These guidelines are intended as a resource to help create and build professional end-of-life doula groups.

As a networking and information hub, NEDA is positioned to bring together EOLDs in a way that enhances their individual and collective knowledge as well as their business opportunities.

Further, NEDA and its partners are able to lend support and credibility to groups of EOL practitioners as they forge their presence in their respective communities. In keeping with its vision, NEDA wishes to help achieve status for EOLDs as qualified practitioners who provide appropriate integrative and ethical care for all people at end of life.

NEDA maintains that there is great value in forming groups, and has identified the following benefits associated with being involved in a group:

- Peer and mentoring support;

- Resourcing and collaborating;

- Sharing knowledge, best practices, referrals;

- Help with cases, if desired; especially during vigil work;

- Cost-savings, reduction in overhead, group insurance;

- Becoming established, and being able to offer a wide range of services;

- Farther service and educational outreach capabilities;

- Increased probability of reaching personal, professional, and business goals.

These guidelines are intended as a launching point, and we wish you and your group the best in success as you design your unique end-of-life doula business practice.

Definitions

Agency

A for-profit business that provides services that connect practitioners and clients. AKA Referral or Staffing agency.

Affinity Group

A group formed around a shared interest or concern, common ideology or goals.

Alliance

An entity that combines the resources of two or more groups or individuals to achieve strategic goals, leverage resources, and increase success potential while reducing risks.

Collaborative

A working group consisting of two or more people or organizations formed for a particular purpose that serves the common good.

Collective/Cooperative

A group of individuals who join together to achieve common objectives for the mutual benefit of its members.

Community of Practice Group

People who share information and experiences within the group to provide opportunities for personal and professional development.

Limited Liability Company

A limited liability company (LLC) is a business in which the owner or owner/member(s) are not personally liable for their company's debts or liabilities.

Network

A group or a system of interconnected people or things.

Not-For-Profit Organization

A tax-exempt, incorporated organization in which neither shareholders nor trustees benefit financially and that serves some public purpose or social cause. 501c3 nonprofits focus on educational and charitable causes, while 501c6 nonprofits are classified primarily as business leagues.

Partnership

A legal entity comprised of two or more partners who share profits & losses.

For-Profit Business

Any business that seeks to generate income for their owners and employees by providing goods and/or services for a fee.

Professional Common Interest Group

A professional association that advocates for the economic and professional development of their members and constituents, such as trade unions and associations. The group may provide certification, professional conduct guidelines, codes of ethics, and shared personal and professional insurance coverage.

Professional Interest Support Group

An organized group of skilled workers who share resources, expertise, and concerns regarding their profession for the purpose of mutual aid and shared problem-solving to reduce solation and increase support between professional peers.

Sole Proprietorship

When two or more people engage in business practices for the purpose of making money with an agreement on division of labor, including business decisions, administrative tasks, liability, and income. If you are earning self-employed income and you have not incorporated, you are a sole proprietor.

Working Group

Any group of individuals with relevant knowledge and skills in specific areas who collectively undertake assigned tasks and activities in order to achieve specified goals and/or a stated objective.

How to Start a Regional Group

All groups hope to promote their mission and services, build a community presence, and sustain their operations. Initiating the setup of any entity begins with the purpose that brings together a community of like-minded individuals who share a purpose and vision. The order of the actions a group takes depends on what works best for the members, taking into consideration the operating and partnership agreements.

Forming a group—the startup process:

- Collaborating to engage and connect members;

- Aligning values, vision, and mission to create a plan;

- Taking inventory of individual members’ skill sets and specialty areas;

- Determining group and leadership structure;

- Agreeing on a decision-making process;

- Assigning a division of labor;

- Deciding how the group will be funded, and what the start-up budget may look like;

- Designating specific services and/or products the group will offer.

Some structural elements for consideration:

- A business plan as roadmap;

- A set of membership guidelines;

- A decision-making philosophy, and a management structure/hierarchy;

- A meeting location, whether in situ or remote;

- A member team or steering committee or board to oversee operations;

- A process for retaining group documents;

- A marketing and public relations strategy;

- A website;

- An intake system;

- A rudimentary accounting system;

- A pathway for legal and tax compliance.

Set-up costs:

Depending on the individual skill sets member volunteers bring to the group, you may be able to defray startup costs significantly. Expect that there may be additional fees and professional services that must be outsourced. Keep in mind that partnerships with a college business class, friendly web developer you know, community leaders who support EOLD work, and other contacts may contribute pro bono to help lower costs in the startup phase.

Fees will vary for many reasons, and depending on where the group is located, whether urban, suburban, or rural. See www.incfile.com/state-filing-fees/ for a chart of fees by state for LLC, nonprofits, and corporations. Here is a range of anticipated startup costs (accessed 2020):

- CPA: approx. $150 to $500/hour.

- Attorney: $150 to $400/hour.

- LLC formation fees are determined by state, anywhere from around $50 to $520.

- Nonprofits: IRS 501c(3) filing fee is $275 to file an EZ-1023, $600 for the full 1023.; 501c(6) 1024 filing fee is $600. State filing fees range from $8 to $270, with an average around $50 – $70.

- Business Coach: $50 to $300/hr. Start-up packages may run from $800 to $2,000.

- Web design: $1,000 to $9,000+.

- Website hosting and maintenance: $20 to $100/mo.; Domain hosting: $15+/year.

- Advertising and marketing: variable, depending on platforms.

- Office or meeting space: variable; consider home or virtual spaces for costs savings.

Professional services:

Along with legal, accounting, and marketing services, the group will want to take stock of their specialty areas and decide if and how they’d like to expand their group offerings. Some EOLD groups contract with, or at least have access to, the following:

- Trained and credentialed grief and/or bereavement counselor(s).

- Celebrant(s) or funeral officiant(s).

- Home funeral guide(s) and/or local funeral home(s).

- Social worker(s) or nursing case manager(s).

- Chaplain(s) or faith leader(s).

- Arts therapist(s), including music and legacy project therapies.

- Massage therapist(s).

- Elder law advisor(s).

- Trained advance directives provider(s) and/or Notary Public.

- Hospice, home health, and/or hospital contacts.

- Experienced EOLD trainer(s) for advice and/or mentorship.

The timeline:

The group’s expectations will affect how long it takes the association to grow. A realistic inventory of personal time commitments, frequency of meetings, how dedicated the group is, and the anticipated pace of group development should be evaluated; all these factors and more will influence how long each step and the overall process will take. An ambitious startup can happen within a year. An organic approach to the process does not emphasize time goals, so members should allow for plenty of time for the group to establish.

Governance Models to Consider

Community of Practice Groups

A Community of Practice Group, also known by these interchangeable terms, may also operate as a:

- Professional Common Interest Group; or

- Professional Interest Group; or

- Professional Interest Support Group;

- other possible titles include affinity group, alliance, collaborative, collective, or network.

Some characteristics of a Community of Practice Group include:

- A clear objective or purpose;

- An established learning community;

- Awareness of the experience and knowledge each member brings to the table;

- Regular meetings;

- Can be either a formal or an informal working group.

Elements of a Community of Practice group include:

- Group goals, objectives, & values are established. The group may create a Charter;

- The group is socially geared, and is essentially learning-based;

- Members willingly belong to the group;

- Roles that define member responsibilities are established

- Those roles may change and/or become more or less formal over time

- Each member enjoys equal status and agrees to actively participate in the group

- The group is not subject to formal (business) rules or regulations;

- There are no explicit guidelines that govern the operations, but there may be standards by which members are held so objectives can be accomplished.

Tips for forming a Community of Practice Group:

- Contact other EOLDs in your geographical area. The directories on the NEDA website may be useful. NEDA and several other EOLD training organizations also have social media pages where you can seek out and connect with colleagues. Attending death Cafes Death Over Dinner, or other events and forums can also provide opportunities to meet and network with other EOLDs in your region.

- Determine who the members are:

- The selection process should be based on common interests, goals, values;

- Consider how many members you want in your group.

- Some suggestions for forming a group:

- be selective about who joins & how many you have in your group;

- establish some membership criteria, i.e., training, specialty areas.

- Explore and decide on the group’s mission or vision, values, and early goals.

- Select a name for the group.

- Determine leadership structure/roles to guide group development:

- Create a “steering committee”, e.g. founding members or “elected” others;

- Brainstorm, make some preliminary decisions, then bring to larger group;

- Consider whether or not the group wants formalized positions, roles;

- Decide whether positions rotate yearly or every two years, or as needed.

- Decide how will the group make decisions—by vote? By consensus? Majority? Other?

Setting up a Community of Practice Group:

- Create a Charter. Consider having Policies & Procedures—how will the group operate?

- Create a strategic action plan or a timeline by which to guide goals achievement.

- Consider a marketing plan—how will the group advertise its services?

- Fee structure—will the members be independent contractors or other?

- How to charge (hourly, per visit, per service, no charge?)

- Fee scale.

- If services are broken out, charges for individual services or packages.

- Identify which other organizations your group wishes to collaborate with, i.e., hospice, funeral home, hospital, doctors, churches, other.

- Determine what you need to market the group/business: a website? Brochure? Cards?

- Consider whether or not the group needs a meeting space, a common billing service, administrative assistance, or other scaffolding.

- Research and build a budget for set-up costs.

- How will the group pay for costs incurred? Dues? Start-up contribution? Cost-sharing?

- Consider if the group will require professional services, such as:

- Legal advice;

- Accounts payable and receivable, & banking;

- Web design, hosting, and maintenance;

- Scheduling and other administrative functions.

Professional Advantages of a Community of Practice Group may include:

- Having the opportunity to develop friendships, thrust, and working relationships;

- Providing a safe space amongst peers to explore the challenges and joys associated with starting up an EOLD business;

- Creating a community, wherein there are opportunities for professional development, including learning skills, building capability, sharing knowledge & stories, etc.;

- Reducing duplication of work and effort in establishing a business;

- Providing group motivation, a wide range of resources, and support;

- Supporting the creation of a mentorship program;

- Learning from the successes and challenges of others in the group.

Possible business advantages of a Community of Practice Group:

- Generally has minimal set-up costs;

- May not require professional services such as an attorney or accountant;

- Each member is an independent contractor responsible for their own EOLD business management and professional liability insurance;

- Members can decide whether or not to work together as teams, for instance, during vigils;

- The operation may be developed into a for-profit or not-for-profit business entity, should that become a desirable goal of the membership;

- May be either a short or long-term proposition, depending on its goals;

- May be organized as a flexible type of group, where members can come and go at will.

Limitations of Community of Practice Groups may include:

- Because it’s organic and informal by nature, a Community of Practice is resistant to supervision or authoritarian-style leadership. If one or two individuals insist on assuming the lead, the group remains centralized, and the members feel undervalued, the organization may not remain viable;

- Group dynamics and group cohesion can be difficult to explore and manage;

- It takes time to build and develop; the process can be very time-consuming;

- Because it is a social learning rather than a business model, it lends itself far better to learning and knowledge-sharing than it does to making money;

- Requires interaction, regular meetings, learning opportunities, and member engagement. When members aren’t fully engaged, the Community of Practice is only so effective.

Not-for-Profit Corporations

501c3 Educational or Charitable Non-Profit Organizations

Non-Profit organizations serve the public interest, and are mostly categorized as tax-exempt by the Internal Revenue Service. The two most likely types for EOLD business groups are the 501c3 organization or the 501c6. A third option, the 501e, may be a 501c3 – Section 501r designation if the group has strong ties with two or more hospitals.

Some characteristics of a 501c3:

Suggested questions to answer before starting up a 501c3 include:

Tips for forming a 501c3

Set-up costs/possible services required for a 501c3 may include:

Advantages or benefits of establishing a 501c3:

Potential difficulty with establishing a 501c(3):

Assumed risks for nonprofits may include:

501c6 Trade or Professional Non-Profit Corporations

In a 501c6 organization, EOLDs would each own their LLC, and carry their own liability insurance. Otherwise, the steps, costs, and benefits/risks involved in establishing a 501c6 business league are much the same (with the exception IRS form 1024 for applying for tax-exempt status for the corporation and form SS-4 to file for the tax ID) as forming a 501c3.

Tips for forming a 501c6 corporation:

The 501e Cooperative Hospital Service Organization

501e Hospital Service Organizations are:

501c3 Educational or Charitable Non-Profit Organizations

Non-Profit organizations serve the public interest, and are mostly categorized as tax-exempt by the Internal Revenue Service. The two most likely types for EOLD business groups are the 501c3 organization or the 501c6. A third option, the 501e, may be a 501c3 – Section 501r designation if the group has strong ties with two or more hospitals.

Some characteristics of a 501c3:

- All 501c3s are highly regulated at both the state and federal levels;

- A 501c3 is typically funded through donations, government grants, or membership dues;

- All assets are permanently dedicated to the education or charitable purpose, with no part of the activities or the net earnings going to any director, officer or private individual. Earnings may go to individuals, however, as legitimate salaries, as long as the amount is reasonable and not excessive. Benefits, paid leave, and bonuses may also be offered. Usually, any surplus revenues go toward achieving the group’s objective or mission;

- Donations made to the 501c3 are tax deductible for the donors;

- Most nonprofits organize as corporations for liability protection of the officers;

- Incorporating a nonprofit is very similar to creating a regular corporation except for the extra steps of applying for tax-exempt status with the IRS, as well as with their state tax division;

- The forms used to file for tax-exempt status from the IRS are the 1023-EZ and the 1023;

- The filing must occur within 27 months from the date of incorporation to qualify;

- Turnaround time to hear from the IRS is variable.

Suggested questions to answer before starting up a 501c3 include:

- Do you have an educational or charitable program?

- Can you feed and care for an organization? Is it sustainable?

- Can you fund the startup?

- Do you have an anticipated budget?

- Have you developed a funding plan?

- Do you have a board of directors willing to commit to the group?

Tips for forming a 501c3

- Write a business plan. This is a very important first step in organizing, even though your nonprofit business may not make much (if any) profit. The plan guides the group.

- Choose a business name. Make sure to check the state-by-state information of the various laws that apply to naming a nonprofit in your state.

- Appoint a Board of Directors. With their input and guidance:

- Create a mission statement;

- Draft bylaws (the operating rules for your nonprofit).

- Decide on a legal structure—choose whether your organization will be a trust, corporation, or association.

- File your incorporation paperwork (Articles of Incorporation) and pay a fee.

- Look up your state office through the National Association of State Charity Officials (NASCO) or go to your state Secretary of State’s office.

- Apply for your IRS tax exemption number (FEIN) by filing forms 1023 (series) and Form 8718 through www.irs.gov:

- This process can be lengthy. It’s like an audit of proposed activity, including a thorough examination of the organization’s governing structure, purpose, and planned programs. Potential conflicts of interest and benefit to insiders are both possible grounds for denial.

- Apply for a state tax exemption number through the Secretary of State:

- You may also have to fill out a Charitable Solicitations Registration through your state’s Secretary or Attorney General’s office.

- Double-check that your nonprofit has all the licenses and permits needed to comply with federal, state, and local rules.

Set-up costs/possible services required for a 501c3 may include:

- Costs include filing fees (FEIN, Articles of Incorporation, relevant licenses):

- Form 1023EZ $275 (revised 2018);

- Tax exemption user fee $600 (revised 2018).

- Consider hiring an account who specializes in nonprofits. They can assist with paperwork, and generally in such areas as planning, incorporating, and operations;

- Consider consulting with an attorney to review your Articles of Incorporation;

- Marketing expenses;

- Website design, hosting, and maintenance expenses;

- Banking—setting up a business account may be desirable, and may carry a small fee.

Advantages or benefits of establishing a 501c3:

- Large support network for EOLDs and their clients, too;

- Resources, knowledge, and best practices are shared;

- The model is built for posterity and will endure, even after EOLDs leave the group;

- EOLD services can be promoted as a brand and cohesive group to the community.

Potential difficulty with establishing a 501c(3):

- Setting up a nonprofit can be labor-intensive on the front end, requiring significant time and energy to accomplish;

- Unless the founder has some prior experience with setting up a nonprofit or can consult with or pay an expert, the process can be somewhat challenging.

Assumed risks for nonprofits may include:

- Like any business, nonprofit organizations face many of the same risks, but the impetus to honor donors’ contributions of time and money make those risks even harder to mitigate within constrained budgets. Nonprofits are accountable to the donors, founders, volunteers, program recipients, and the public—which demands a high degree of honesty, trustworthiness, and openness. If members aren’t ethically aligned, lack of public confidence can affect the success of the group. Financial instability, liability, and damaged reputations are the top concerns. Other possible concerns include:

- Theft and fundraising fraud;

- Regulatory compliance—[note: be sure to fill out Form 990 annually!];

- Directors take on liability risk, can be held personally accountable for a variety of claims;

- Volunteer training and management can be time-consuming, sometimes with limited return on investment;

- Maintaining the organization over time can be challenging, especially financially.

501c6 Trade or Professional Non-Profit Corporations

In a 501c6 organization, EOLDs would each own their LLC, and carry their own liability insurance. Otherwise, the steps, costs, and benefits/risks involved in establishing a 501c6 business league are much the same (with the exception IRS form 1024 for applying for tax-exempt status for the corporation and form SS-4 to file for the tax ID) as forming a 501c3.

Tips for forming a 501c6 corporation:

- Choose a group name;

- Appoint a Board of Directors and/or an Advisory Council;

- Create a mission statement and bylaws (with Advisory Council or the Board of Directors);

- File Articles of Incorporation with State Secretary or Attorney General’s office.

- Complete and submit IRS Form SS-4 to obtain a Federal Employer Identification Number;

- Apply for tax-exempt status by filing IRS Form 1024;

- Complete copy of IRS Form 8718 and have someone with power of attorney sign the application. Submit proof of FEIN and fees;

- Contact your State Department of Revenue for their tax-exempt status rules and application;

- Consider consulting with a nonprofit accountant;

- Consider creating a website for marketing, promotional, and educational purposes;

- Consider/plan for who will run the administrative side of the organization.

The 501e Cooperative Hospital Service Organization

501e Hospital Service Organizations are:

- Nonprofit organizations affiliated with and providing cooperative services for two or more hospitals;

- Service organizations with the goal of supporting sick patients and their families;

- Funded by donations which are tax exempt;

- FORM 1024 must be filed with the IRS to register as a 501e;

- The steps to form such an organization are similar to the steps above.

For Profit Entities

Referral Agencies

Some characteristics of an Agency:

Elements of an Agency:

Tips for forming an Agency:

Professional services possibly needed may include:

Advantages to owning or working for an Agency may include:

Risks or limitations of owning or working for an Agency may include:

Limited Liability Company

Some characteristics of a Limited Liability Company (LLC) include:

Tips for forming a Limited Liability Company:

Set-up costs/possible services required:

Benefits of a Limited Liability Company may include:

Risks/disadvantages of a Limited Liability Company may include:

Partnerships

Some characteristics of a Partnership include:

Tips for forming a Partnership:

Set-up costs/possible professional services required:

Advantages of a Partnership may include:

Risks/possible disadvantages of a partnership may include:

Referral Agencies

Some characteristics of an Agency:

- An agency is a company that refers EOLDs to clients or clients to EOLDs;

- The agent is familiar with client needs, and keeps a database of leads;

- The agent matches the client with the doula, receiving a commission for referrals;

- The agency works on a contract-basis;

- It can take considerable time, effort, and money to establish a fruitful agency.

Elements of an Agency:

- The owner of the agency is the manager, designer, and operator of the business;

- The owner may or may not be an active EOLD;

- The owner may keep a percentage of client fees;

- The owner handles the inquiries, intakes, and the cases;

- The owner hires or contracts with EOLDs and matches them with clients;

- The owner is fully responsible for the financials and all liabilities.

- The EOLD can be a designated employee or an independent contractor. There are different tax and legal implications;

- The EOLD can also be a free agent, working both for the agency and for themselves at the same time.

Tips for forming an Agency:

- Consider having partnerships or co-founder(s) to share in business responsibilities.

- Determine what services agency will offer, or what niche the agency will fill.

- Choose a location and territory for the agency.

- Name the business. Consider trademarks, domain availability, and long-term suitability in case you might want to incorporate down the road.

- Decide what the EOLD qualifications will be, and select a vetting process, i.e., background check, driver’s record, verification of training, certifications, reference checks, personal interview.

- Create the agency’s fee structure.

- Formalize policies and procedures.

- Advertise and market the agency and its services to attract clients.

Professional services possibly needed may include:

- Accounting, bookkeeping, business training, coaching, web design, web hosting, marketing.

Advantages to owning or working for an Agency may include:

- Support and back-up may be readily available;

- Owner communicates with client about money and addresses client’s concerns and issues—so the EOLD doesn’t have to;

- Owner does the initial assessment of the case and determines needs;

- Owner does all the problem-solving and handling, EOLD renders the services;

- Owner keeps percentage of fees—can be a profitable venture for owner;

- Agency makes decisions for the well-being of the business, so the EOLD doesn’t have to be concerned about the business aspects of the work and can focus on caregiving.

Risks or limitations of owning or working for an Agency may include:

- The owner may not have reasonable expectations of the work (unless they’re an EOLD themselves); pay may not be adequate to sustain the EOLD;

- Personnel issues—having too few or too many EOLDs may lead to not enough or too much work; there may be competition or favoritism involved;

- Agency guidelines may or may not be conducive to the ethics or standards of care the EOLD would like to see/maintain;

- The EOLD may not follow agency guidelines, creating problems for the owner, and possible harm to the reputation of the agency;

- The owner risks no-return on the investment of time, energy, and funds they put into their business.

Limited Liability Company

Some characteristics of a Limited Liability Company (LLC) include:

- An LLC may be well-suited for companies with a single owner, or for companies with more than one owner. The owners of an LLC are called members. There must be at least one member;

- It’s an enticing model for small business owners because it’s self-governing;

- There is no Board of Directors, no regular meetings to be held;

- An LLC has a separate legal existence from the members’ individual holdings, so it offers protection of owners’ assets; the member(s) is/are protected against the business liabilities of the company;

- An LLC has flexible taxation classifications—the IRS doesn’t recognize LLCs as a separate tax entity. LLC taxes are filed either as a sole proprietorship or as a partnership or as a C-Corporation or an S-Corporation. You choose;

- There is simplicity in operating an LLC, and flexibility in management structure; the operations of an LLC are managed by the managing members;

- An LLC requires little bookkeeping, and administrative requirements are simple.

Tips for forming a Limited Liability Company:

- Create a business plan. Although not required, it’s wise to have a roadmap.

- Choose a business name. Search availability before decision.

- Register your business status with the Secretary of State.

- File Articles of Incorporation forms.

- Apply for Federal Employer Identification Number (FEIN) with the IRS. The FEIN is the official tax number needed to open bank accounts, apply for loans, and file tax returns.

- If forming a partnership LLC, draft a Partnership Agreement (may merge with Operating Agreement into one document).

- Document meeting agendas, activity, and decisions.

- Consult state law about requirements to publish a notice of intent to form an LLC or obtain a license/permit.

- Open a business bank account to establish transactions.

Set-up costs/possible services required:

- Filing of paperwork (Article of Organization with State);

- The member(s) may want to have a website built and hosted;

- The member(s) may want the advice of a CPA or business coach/mentor.

Benefits of a Limited Liability Company may include:

- Pass-through taxes. There's no need to file a corporate tax return. LLC members report their share of profit and loss on their individual tax returns, so you avoid double taxation;

- No residency requirement. Those who own/operate an LLC need not be U.S. citizens or permanent residents;

- Legal protection. Creating an LLC gives you limited liability for business debts and obligations;

- Enhanced credibility. Partners, lenders, even clients may look more favorably on your business when it's established and incorporated as an LLC.

Risks/disadvantages of a Limited Liability Company may include:

- The member(s) must pay employment tax on company earnings;

- LLCs are governed by state laws, so member(s) may have to pay tax in some states, while no tax may apply in other states;

- Limited growth potential. LLC members cannot issue shares of stock to attract investors;

- Lack of uniformity. An LLC can be treated differently in different states;

- Self-employment tax. LLC earnings may be subject to this type of taxation;

- Tax recognition on appreciated assets. This could happen if you convert an existing business to an LLC. It depends on state tax laws.

Partnerships

Some characteristics of a Partnership include:

- Two or more EOLDs formally agree to become partners;

- The business management style may be flexible, depending on the partners;

- All partners agree to any liability that their partnership may face;

- There must be proof that an agreement has been made (can be oral, but written is preferred);

- There are equal shares of duties and profits, as well as liability or debt incurred;

- Taxes do not flow through a partnership. Instead, all partners will be responsible for taxes including any money earned through the partnership on their own personal taxes. Only the percentage of your profits earned will be calculated on your taxes;

- Decision-making is shared. Some partnerships make use of a steering committee to assist.

Tips for forming a Partnership:

- Consider type of business partnership agreement you want to create;

- Choose a name;

- Register the partnership with the State and the IRS;

- Discuss percentages of ownership;

- Determine how to share profits and losses;

- Establish clear rights and responsibilities;

- Agree on values, goals, and how the business will be managed;

- Agree on the division of labor, including: scheduling, including on-call, intake and referrals; marketing, events, public outreach; accounting/bookkeeping; and administrative and managerial details.

Set-up costs/possible professional services required:

- Marketing materials, website design and hosting costs.

- Lawyer fees for preparing or reviewing the written partner agreement.

- Individual insurance.

Advantages of a Partnership may include:

- Easy to form, register, and launch;

- Shared responsibilities, tasks, liability;

- Holiday benefits—you can take a vacation and still have coverage;

- Mutual support;

- Profit and cost sharing;

- Risks and losses aren’t carried by one person.

Risks/possible disadvantages of a partnership may include:

- Partnerships are only successful when both partners are truly committed to business goals;

- Differences in work ethic, decision-making styles, goals may lead to disputes or conflicts;

- One partner’s actions, behavior, or personality affects all/the health of the business;

- There’s unlimited liability of business expenses, with little protection;

- Dissolution (due to personal circumstances and/or differences) may occur at a higher rate than in some other business models.

Suggested Best Practices

When forming a group, be selective. Ask potential group members these questions:

Suggestions for structuring the group:

Suggestions for maintaining the group over time:

Suggestions for group management:

Acknowledgments

The NEDA Board of Directors formally acknowledges and thanks the committee members and consultants who so generously contributed their time, knowledge, and collective experiences to the development of the NEDA Regional Groups Guidelines.

The author of the document would like to extend special appreciation to Victoria Quinn-Stephens for her vision and leadership in the process. It is the committee’s hope that these Guidelines may offer guidance and encouragement to EOLDS who wish to create and/or solidify their own distinct local groups in service to the dying and their families.

Our thanks to:

Patty Brennan of Lifespan Doulas, Ann Arbor, MI

Neidra L. Clark of End of Life Doulas of the Triangle, Hillsborough, NC

Lori Goldwyn of East Bay End-of-Life Doula Network, East Bay’s End-of-Life Learning Community, Point Richmond, CA

Vanessa Johnston of Colorado End-of-Life Collaborative, Denver EOLDoula, LLC, Denver, CO

Jessica Kilbourn of Heart In Hands, LLC, Ypsilanti, MI

Anne Murphy of A Thousand Hands, Minnesota Death Collective, Minneapolis, MN

Lisa Patterson, Committee Chair and document author, former NEDA Board Member

Victoria Quinn-Stephens, Evening Star End-of-Life Doula Services, Portland, OR

Toula Saratsis of Heart in Hands, LLC, Ann Arbor, MI

Resources

Books and Published Papers

Patty Brennan, The Doula Business Guide, 3rd Edition. (DreamStreet Press, 2019)

Etienne Wenger, Communities of practice: learning, meaning, and identity. (Cambridge University Press, 1998)

Etienne Wenger, Richard McDermott, and William Snyder. Cultivating communities of practice: a guide to managing knowledge. (Harvard Business School Press, 2002)

Etienne Wenger and William Snyder. Communities of practice: the organizational frontier. (Harvard Business Review,January-February 2000) pp. 139 - 145.

Etienne Wenger. Knowledge management is a donut: shaping your knowledge strategy with communities of practice. (Ivey Business Journal, January 2004)

Online Resources

For Community of Practice or Community of Interest Groups

When forming a group, be selective. Ask potential group members these questions:

- What is your main focus or objective for being part of a group of EOLDs?

- What is your area of interest or your specialty service area?

- How much time & energy are you willing to give to the group?

- What do you expect to gain from being a group member?

- What do you expect to give to other group members?

- Are you willing to commit to the group vs. being in it for your own gain?

- Also, consider how many EOLDs you want to have in your group. Some collectives limit the number of members to keep the group running efficiently, while others invite as many prospective members as possible to enhance service offerings.

Suggestions for structuring the group:

- Identify an organizational or governing model—what type of group will you be?

- Identify a leadership structure. Will there be a steering committee? Are there officers? A leader or co-leaders? A facilitator? A leadership rotation? Generally, the founders of the group provide initial leadership function; they kick off the group, and guide its development and management during the start-up phase.

- The members of the group should all have buy-in to the values, goals, and mission of the organization.

- Decide how the group will make decisions.

- If there are “jobs” within the group, what are the roles? What is the division of labor?

- How long is a term? Will jobs be rotated?

- Some possible positions include:

- Intake Coordinator

- Member Coordinator

- Meeting Facilitator

- Meeting Recorder

- Outreach Coordinator

- Treasurer

- Webmaster

- Create useful policies and procedures or group rules.

Suggestions for maintaining the group over time:

- Utilize and maximize each member’s interests, strengths, and connections.

- Be willing to compromise to reach consensus. Discuss must-haves and strong opinions and why they’re important so everyone understands the decision.

- Develop connections with other “death professionals” in your area for networking, referrals, resource sharing, and mutual education.

- When a member feels the group is no longer a good fit for them, they should leave.

- Watch for dysfunctional group dynamics, and problem-solve before they become sticky. Don’t be afraid to air your differences and grow from your mistakes.

- Have some fun together! Do team or relationship-building. Create a space where all are heard and valued. Care for one another.

Suggestions for group management:

- As a group, determine the expectation for a minimum level of participation. For example:

- The EOLD will attend 50% of all meetings; or

- The EOLD will fill one of the identified roles in the group; or

- The EOLD will commit to a giving one workshop/presentation every 6 months.

- Track group members’ meeting attendance and other productivity to keep them accountable and engaged.

- Create an EOLD information spreadsheet which tracks:

- Availability

- Distance willing to travel/preferred territory

- Areas of interest/expertise

- Contact info

- Preferences

- Cultivate ad-hoc committees or sub-groups for projects such as marketing, public education & outreach, and group learning events; use individual skills and group momentum to move it forward!

Acknowledgments

The NEDA Board of Directors formally acknowledges and thanks the committee members and consultants who so generously contributed their time, knowledge, and collective experiences to the development of the NEDA Regional Groups Guidelines.

The author of the document would like to extend special appreciation to Victoria Quinn-Stephens for her vision and leadership in the process. It is the committee’s hope that these Guidelines may offer guidance and encouragement to EOLDS who wish to create and/or solidify their own distinct local groups in service to the dying and their families.

Our thanks to:

Patty Brennan of Lifespan Doulas, Ann Arbor, MI

Neidra L. Clark of End of Life Doulas of the Triangle, Hillsborough, NC

Lori Goldwyn of East Bay End-of-Life Doula Network, East Bay’s End-of-Life Learning Community, Point Richmond, CA

Vanessa Johnston of Colorado End-of-Life Collaborative, Denver EOLDoula, LLC, Denver, CO

Jessica Kilbourn of Heart In Hands, LLC, Ypsilanti, MI

Anne Murphy of A Thousand Hands, Minnesota Death Collective, Minneapolis, MN

Lisa Patterson, Committee Chair and document author, former NEDA Board Member

Victoria Quinn-Stephens, Evening Star End-of-Life Doula Services, Portland, OR

Toula Saratsis of Heart in Hands, LLC, Ann Arbor, MI

Resources

Books and Published Papers

Patty Brennan, The Doula Business Guide, 3rd Edition. (DreamStreet Press, 2019)

Etienne Wenger, Communities of practice: learning, meaning, and identity. (Cambridge University Press, 1998)

Etienne Wenger, Richard McDermott, and William Snyder. Cultivating communities of practice: a guide to managing knowledge. (Harvard Business School Press, 2002)

Etienne Wenger and William Snyder. Communities of practice: the organizational frontier. (Harvard Business Review,January-February 2000) pp. 139 - 145.

Etienne Wenger. Knowledge management is a donut: shaping your knowledge strategy with communities of practice. (Ivey Business Journal, January 2004)

Online Resources

For Community of Practice or Community of Interest Groups

- www.ohr.wisc.edu/cop/articles/communities_practice_intro_wenger.pdf

- www.elearningindustry.com

- www.adaptmethodology.com/communities-of-practice

- www.mitre.org/publications

- Upcounsel www.upcounsel.com/typesofnonprofits

- IRS www.irs.gov/businesses

- Small Business www.smallbusiness.chron.com

- Nat’l Association of State Charity Officials www.nasconet.org (for state licenses)

- Secretary of State look up by state (.gov)

- Attorney General’s office look up by state (.gov)

- Small Business Association www.sba.gov

- How to start an independent agency www.independentagent.com/resources

- How to structure a partnership www.inc.com/guides

- How to start an LLC www.irs.gov/limited-liability-company

- How to form an LLC, A step-by-step guide www.startingyourbusiness.com

- Fee Chart by State Inc. File.com www.incfile.com/state

Copyright 2023 National End-of-Life Doula Alliance, nedalliance.org

|

NATIONAL END-OF-LIFE DOULA ALLIANCE (NEDA)

2423 SOUTH ORANGE AVE #115 ORLANDO, FL 32806 NEDA is a nonprofit 501c6 membership organization dedicated to supporting end-of-life doulas and the families they serve. Content on this website is for informational purposes only and is not offered as legal advice. |